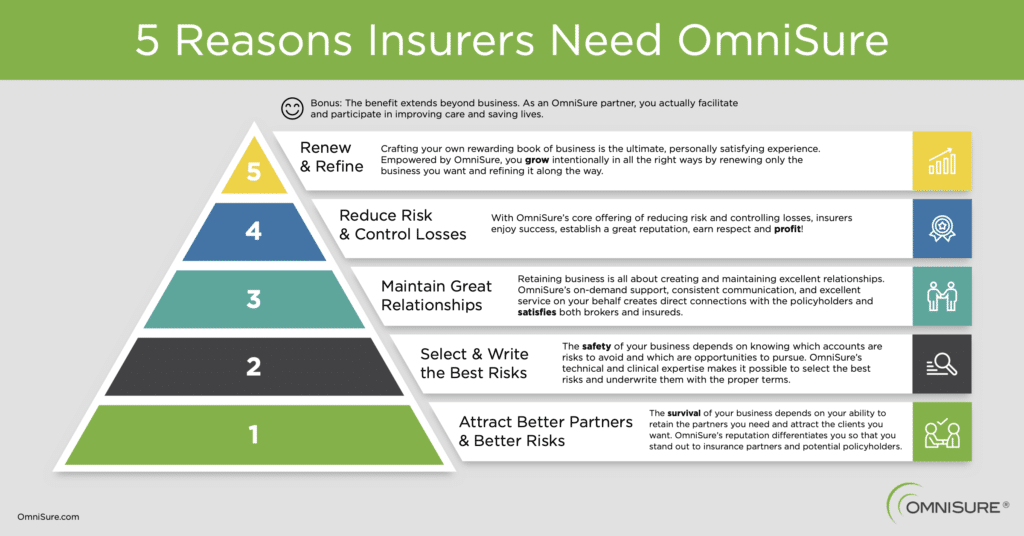

Successful insurers attract, bind, and retain the right business at the right price with the combined ratio they desire. OmniSure can assist in all these areas with our invaluable resources and many years of industry expertise resulting in a more profitable book of business for you. Here are the top five reasons you need OmniSure:

1. Attract Better Risks

You want to attract quality providers and operators to your insurance program. Quality providers of healthcare and human services are less likely to have losses because they are eager to reduce risk and improve outcomes, and they expect their insurance partner to provide the supportive services needed to help them achieve their risk management goals. OmniSure provides training, resources, on-demand advice from experts, and comprehensive assessments to help your policyholders avoid, reduce, and better manage the risk of claims.

2. Select and Write the Best Risks

Our technical expertise and dedicated specialists help you craft better policies by more deeply understanding and staying up to date on the latest trends, regulatory changes, and service offerings in healthcare and human services. Whether it’s deep insights on emerging risks, training related to a specific business niche, or prebind risk consults on potential new business, our specialty-specific clinical knowledge is your key to selecting, underwriting and properly pricing the best risks.

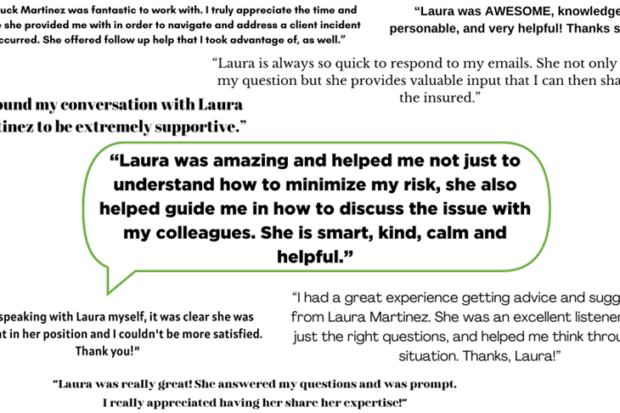

3. Maintain Better Relationships

We go beyond the initial risk assessment and recommendations to help you stay profitable. OmniSure produces co-branded educational materials and stays engaged with your policyholders on your behalf, equipping them with a library of tools, training videos, and the ongoing support they need to avoid losses and improve outcomes, at no additional expense. Policyholder engagement not only reduces losses, it builds relationships and drives retention.

4. Reduce Risk and Control Losses

Risk assessments provide a snapshot widescale look at your policyholders’ operations but it’s what happens during the policy period that determines the outcome. Because OmniSure stays engaged with your policyholders throughout the policy period, we help identify and address issues in real time, as they arise. Policyholders get monthly risk tips are continuously encouraged to take advantage of our confidential helpline for advice-on-demand, which is answered live 24/7. And they do! OmniSure’s deep bench and nationwide network of diverse specialists mean your policyholders get personalized pre-claim loss prevention advice from consultants who speak their language because they’ve worked directly with their unique profession or business.

5. Retain and Refine the Risks You Want

Long term success in this business is the result of valuable relationships built on mutual trust and exceptional service. You want to know that your policyholders are doing what you expect of them and they want to know you are there when they need you most. We are key to building that relationship; a trusted set of outside eyes and an advisor for you when it comes whether and at what terms to renew; and a caring professional for the policyholder with the advice they need when they need it. Many policyholders are happy to renew, even if it means paying higher rates than they could get elsewhere, because of the service they’ve received from their carrier by way of OmniSure.

BONUS: Better care. Saving lives.

If you are in the business of insuring healthcare and human service organizations, and you provide your policyholders with OmniSure’s services, you are extending more than professional liability policies. Your offering extends the benefit of better care and saving lives. Policyholders tell us regularly that our risk assessments and recommendations, advice-on-demand, and proactive risk and safety resources have saved their patients’ lives and in some cases their very careers.

If you’re interested in learning more about partnering with OmniSure to build a successful book of business, prevent losses and improve care, get in touch with one of our experts today.